What is a Protocol in Blockchain?

Money is one of the oldest “technologies” of humankind - a technology to communicate value.

There have been many forms of money throughout millennia:

- From Barter to Bones

- Feathers to Precious Metals

- Gold-backed currencies to today’s fiat currencies

Blockchain might be the technological advance that was needed to move to the next chapter in the history of money: cryptocurrencies.

One of the great innovations of the blockchain boils down to it being a protocol to transfer value. Andreas Antonopoulos calls Bitcoin “a language to communicate value”, which feels like a very accurate description.

The protocol is the set of rules and standards that governs the overall workings of the blockchain.

Network protocols are policies and standards made up of rules, formats and procedures that define communication between a pair of devices, or more, over a network.

Blockchain for Value Transfer

The inception of the blockchain defines this set of rules, procedures, and formats. These rules can only be altered if a majority of network participants decide to do so.

Public blockchains require consensus building, which in turn requires careful consideration of each change proposed. This desirable feature helps to create a robust foundation of trust for the users.

Without the right incentive system and economic considerations, global digital money cannot work. Without building a cognitive bridge between the technology and the monetary aspects one is left with an incomplete picture of what blockchain can be.

Before Bitcoin, digital scarcity didn’t exist. Digital goods were infinitely copyable, so their natural value was theoretically zero, as you have an unlimited supply and limited demand.

Today the exchange of value works similarly to the exchange of information pre-Internet:

- From point-to-point

- Involving middleman

- And third parties

Cryptocurrencies present an innovation to value transfer, just like the internet revolutionized the exchange of information; from peer-to-peer with a highly reduced need for a middleman.

A well designed system for a global exchange of value also enables greater social scalability. When we say system, we implicitly say protocol, as the protocol defines the system.

The term social scalability refers to the ability of large groups to cooperate effectively.

A blockchain can be separated into two layers:

- The Application layer

- Handles functions such as mining, processing and transaction management

- The Network layer

- Handles communication between nodes

The Internet - A Protocol to Transfer Information

When numerous people want to cooperate, a set of standards is always needed to specify exactly how each person should collaborate. The need for a set of standards is the same whether they want to exchange information via the internet or cryptocurrency via the blockchain.

The internet protocol - TCP/IP - defines standards for how data is split up and transferred from a server to your computer, for example, when you access this website.

A blockchain is defined by a protocol that determines how its participants exchange value.

The Mail - A Protocol to Transfer Physical Goods

A straightforward analogy would be comparing blockchain to the mail - a “protocol” to transfer physical goods.

Let’s forget about the post as an entity operating the mail service for a minute and think about it this way:

The mail is permissionless because:

- Anyone who wants to send a letter can access the service by putting the letter in a postbox near them

- It will arrive at its destination a few days later

- You don’t need to ask for anybody’s permission to do so

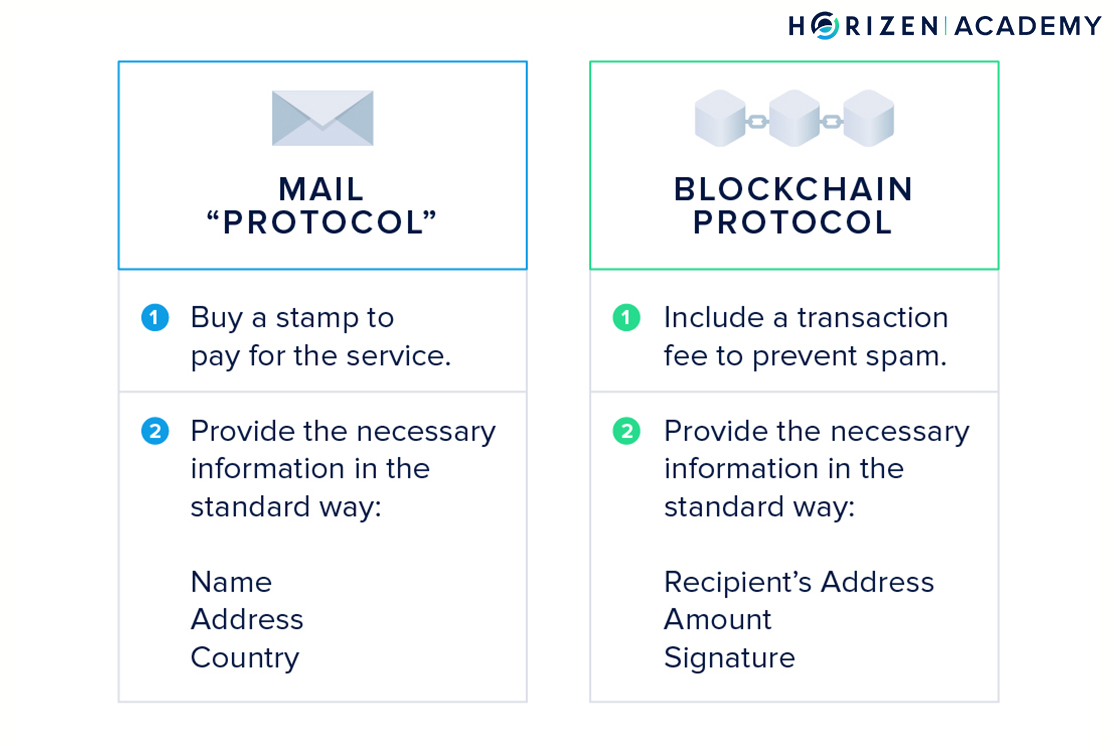

The “protocol” for sending a letter comprises two things:

- You must put a stamp of sufficient value on it

- You must provide the recipient’s address.

The standard address format is a name, address, and country if you want to send the letter abroad.

When you are sending some cryptocurrency, the decentralized network transfers your money to the recipient.

The protocol requires you to add a small transaction fee - similar to a stamp - and provide the necessary information in a standardized way:

- The recipient’s address

- The amount to transfer

- And your signature

Wallets make it easy to receive and send transactions.

They also create your signature for you, without you even noticing, so don’t worry if this sounds complex at first. Addresses on a blockchain are, of course, a little different to addresses that you are used to - they look like this:

znWPHuCGsgnJ5nsdu9AJdDcxDPWdrESoMNT

Signatures are also different from what you know.

Network Protocols

Spoken languages, the internet, and blockchains can be understood as network protocols.

Each has a set of rules, so they can serve their purpose without the need for a middleman, and each is used within a group of participants - the network. All are in agreement, that abiding by the rules yields greater benefit to an individual than breaking the rules.

You could invent your own language in case you don’t want to follow the rules of an existing one, but you wouldn’t have anybody to talk to.

One could also argue that the TCP/IP protocol could be replaced by a more efficient protocol. But if you were the only one using the new protocol, it would be pointless without anybody to exchange information with.

The increase in utility with a growing number of participants is called the network effect.

With cryptocurrencies, we have a similar situation. Cryptocurrencies can be viewed as money, and therefore as information. Money is a very specific kind of information, but it can be understood as such.

In order to communicate information, all participants need a set of rules that they collectively abide by:

- What does a given word mean?

- How do you request information from a server?

- And what does a transaction look like?

This set of rules is what we mean by the protocol of a blockchain. It covers everything from how the data is handled, to how the peers communicate in the peer-to-peer network, to how the network reaches consensus on a single history of transactions.

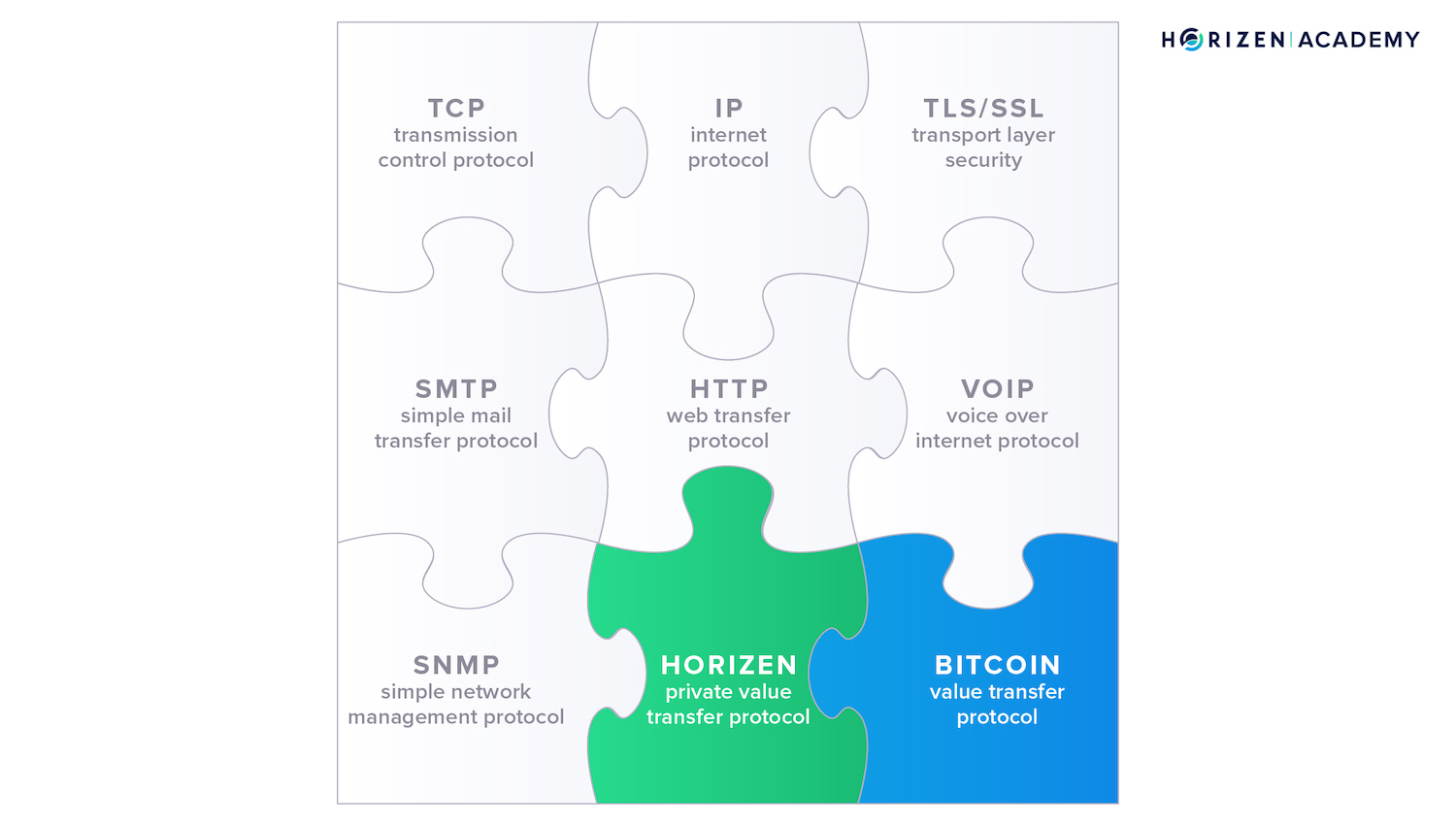

You can distinguish between several broad types of networking protocols. Some examples include:

- Network communication protocols like TCP/IP (Transmission Control Protocol - Internet Protocol)

- Network security protocols like HTTPS and SSL (Hypertext Transfer Protocol Secure/Secure Sockets Layer)

- Network management protocols such as SNMP and ICMP (Simple Network Management Protocol/Internet Control Message Protocol)

- Value transfer protocols such as Horizen or Bitcoin

Above you see a collection of protocols, many of which you use every day.

The TCP/IP protocol specifies how to break data down into packets, address the packets, and route them through the network to their final destination. You are using the TCP/IP standard any time you go online to communicate with different servers to receive the information you want to access.

SSL, or Secure Sockets Layer, is a standard protocol used to establish encrypted links between a web server and a client, like your computer, in online communication and is used for the secure transfer of data.

The Simple Network Management Protocol (SNMP) is a set of protocols supported by network devices such as routers, servers or printers and takes care of them interoperating seamlessly, sometimes. Protocols like Bitcoin or Horizen enable the digital transfer of value from peer to peer.

Throughout the history of the internet, people have defined standards for the exchange of various types of data. It’s important to note that it was not always the best protocol that gained mass adoption. People are unlikely to switch to a different protocol once they begin using it and building upon it.

Developers become attracted to the increasing number of libraries and tools available for these protocols. This cycle repeats until a protocol eventually becomes the standard for a given use case.

Bitcoin is in a good position to become the agreed-upon standard for the storage and transfer of value across the internet. Bitcoin is a convention that specifies rules, procedures, and formats for the transfer of money online without intermediaries. Horizen aims to become the standard for private value and data transfer in the decentralized web 3.0.

People like to point out that the throughput, mostly referring to the number of transactions per second, blockchains can handle, is not sufficient for mass adoption. We believe that using sidechains is a viable way to overcome those growing pains.

Scalability is a discussion in and of its own. We are confident in saying that a distributed ledger of some sort will become the agreed upon standard to transfer value in the future. Bitcoin has the greatest adoption of all cryptocurrencies today.

Many projects and companies have started building upon the Bitcoin protocol. In the past, this kind of adoption was the first indicator of the success of a protocol.

What are the Rules?

Understanding that a protocol is a set of rules and conventions used for a given purpose, let’s take a look at what the protocol of a blockchain looks like.

- What are the rules?

- What needs to be standardized and regulated in order for the system to work?

The main goal is to maintain a consistent ledger of all transactions and there are several rules in place to achieve that. First of all, we need certain standards on what the data like transactions and blocks needs to look like.

- Which order the data for a valid transaction is provided in?

- What formats are used?

- Which structures are used within a block?

All of these conventions are defined by the protocol.

When a common language for the software to exchange information is established, we need rules on how new data is added to the blockchain. Adding data comes at a cost. This cost must be high enough to prevent large amounts of useless data being added, but at the same time it must not be prohibitively expensive.

Each node keeps a copy of the blockchain and verifies every transaction it receives. All miners and full nodes maintain the so-called mempool, which contains new and unconfirmed transactions.

Once a transaction becomes verified it is then saved in the mempool, short for memory pool, with all the other transactions that are not yet included in a block.

When a node receives a new block from its peers, it checks the validity of the block. If it is valid, then it is added to the local copy of the blockchain and all transactions included in the block are removed from the mempool. Once a transaction is included in a finalized block, it is removed from the mempool. The mempool will only ever contain unconfirmed transactions.

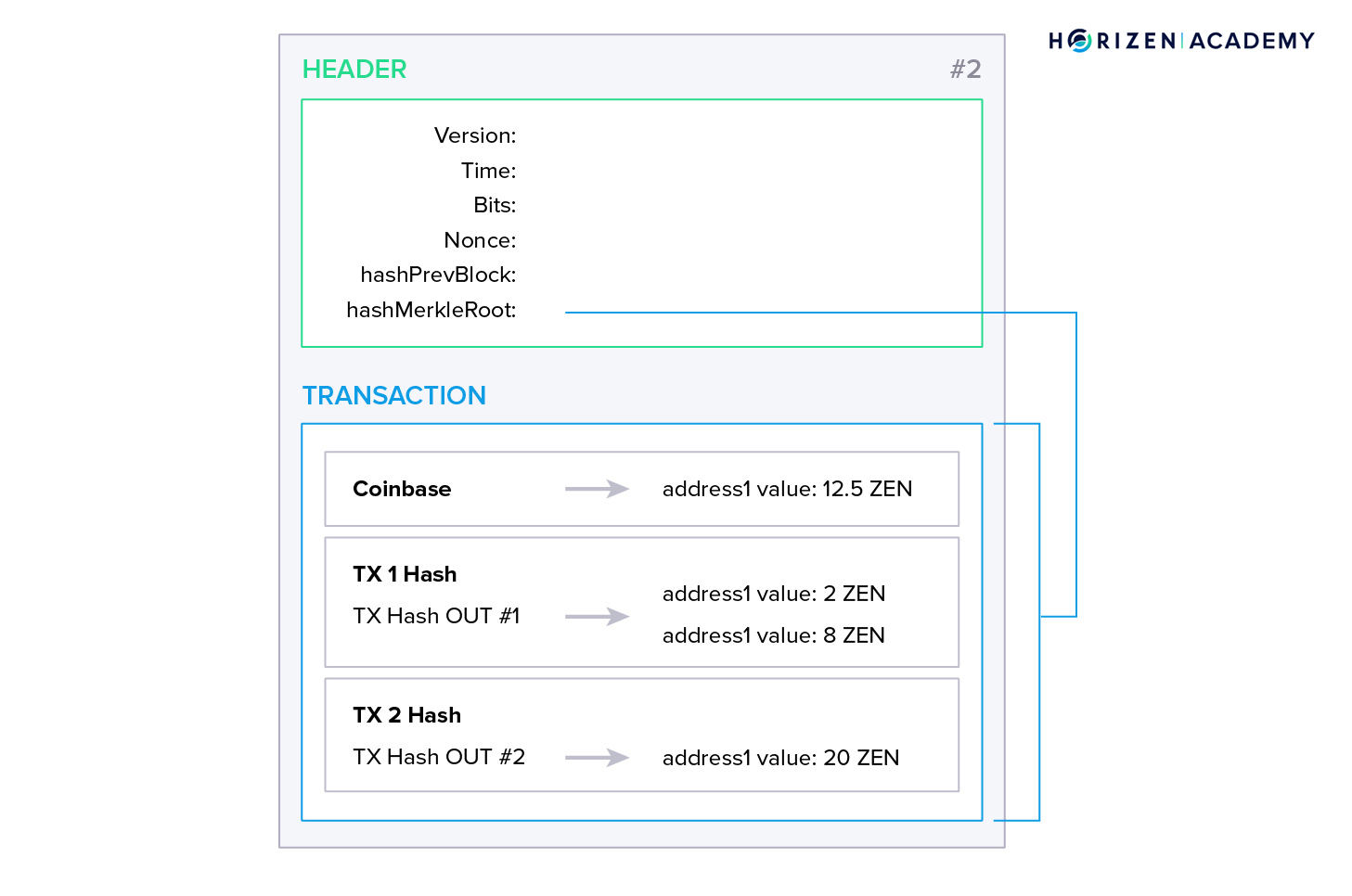

Another subset of rules is concerned with the structure of a valid block. A block is just a container for data. A block has a block header that contains information about the version of the client it was created with, a reference to it’s preceding block (its hash), a summary of all transactions that are contained in the block (the Merkle root), a timestamp, and other metadata.

Following the block header, the block contains all the transactions that were included.

Now there needs to be a set of rules describing what an individual transaction must look like.

A transaction needs to include:

- The sender

- The recipient

- The amount to transfer

- And a digital signature.

The digital signature is a way to authorize the spending of your funds. The private key of a user creates this digital signature.

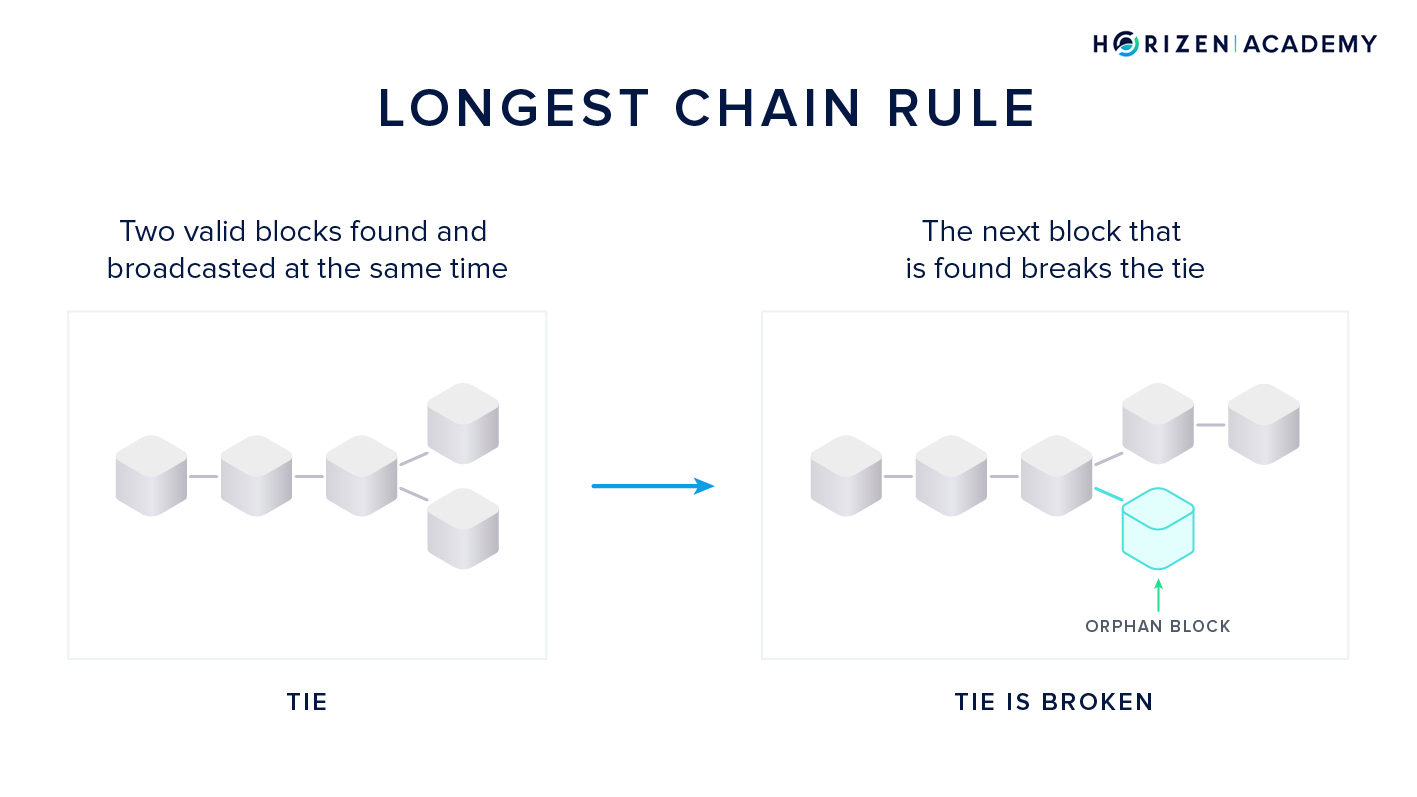

The consensus mechanism determines how the process of adding new blocks to the chain works and how the network agrees on a single version of history.

The longest chain rule or Nakamoto Consensus determines which block is valid in case two miners find two valid blocks shortly after another, creating a tie situation.

To keep the growth of the blockchain stable with regards to the number of blocks added per time unit, a difficulty adjustment is in place. The more miners support a network with their hashpower, the faster they would find blocks on average if there was no countermeasure in place.

If the total hashrate increases, the block difficulty does, too. The average block time is kept more or less constant through this mechanism.

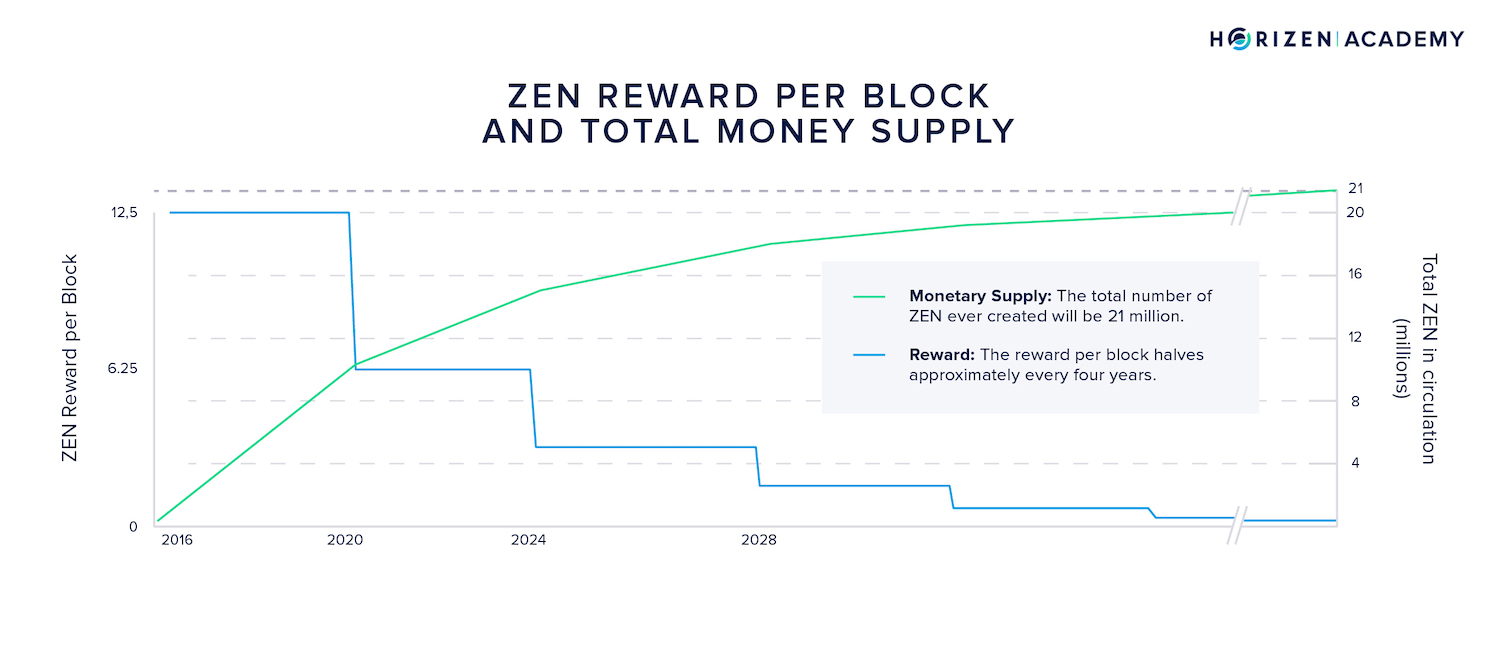

Lastly, the monetary policy is defined in the protocol. Most cryptocurrencies have a maximum circulating supply defined with their inception.

By cutting the block subsidy in half regularly, with Horizen every 840,000 blocks, with Bitcoin every 210,000 blocks, both roughly equal to 4 years, the total circulating supply asymptotically approaches its limit but never crosses it.

This type of monetary schedule is referred to as disinflationary.

The predictable monetary supply is one of the greatest differentiators between government-issued fiat currencies controlled by central banks.

Key takeaways should be that the somewhat abstract term protocol is a set of rules that defines a given blockchain and all of its bits and pieces.

How to Change the Rules of a Blockchain?

The initial set of rules for a blockchain is defined with the genesis block.

Any changes to it need to be approved by the majority of network participants. In a distributed environment without central control, a consensus has to be built around each proposed change to the protocol.

In this respect blockchain development is not too different from many other open source projects. We would like to differentiate between, the process of suggesting changes, the process of deciding on those changes, and lastly, the process of implementing those changes

To suggest changes, most large blockchain projects have an improvement proposal system.

Anybody is able to look at the code on GitHub and suggest improvements, usually by presenting the according code. Within the developer community, the suggested improvements will be discussed, refined and if the majority considers them to be beneficial and not negatively affecting the security they might be implemented.

Deciding upon changes is referred to as the governance of a protocol. Oftentimes, this is only a loosely formulated set of guidelines, but it can be more structured.

Implementing changes can happen via soft forks or hard forks, where soft forks are downward compatible updates and hard forks are downward incompatible.

If changes to the protocol can be implemented with soft forks, there are two ways of how this transition can be handled.

In a User Activated Soft Fork, or UASF the changes are being enforced by the node network. Node operators update their software at a specific flag date and will accept or reject a miner’s block based on the new set of consensus rules. Miners have a strong incentive to adhere to the new rules as they risk mining invalid blocks otherwise.

A Miner Activated Soft Fork, or MASF, does not require the changes to be tied to a specific flag date. Miners can signal readiness for a MASF by changing the version bits in their blocks headers. Once a certain percentage of produced blocks have signaled readiness to update, full nodes can enforce the rule changes accordingly.

The Great Innovations Introduced with Bitcoin

Even if a perfectly designed set of rules is in place, it still has to be enforced somehow. Without a central authority, external enforcement is not possible. The protocol, therefore, presents a self-enforcing agreement.

Game Theory is the study of mathematical models of strategic interaction between rational decision-makers. Miners, nodes, and users of cryptocurrencies are the rational decision-makers

Here, rational means each person is trying to maximize their personal benefit. When Satoshi Nakamoto published the Bitcoin whitepaper, he introduced a system in which each participant is economically incentivized to follow the rules of the protocol.

In other words, it is more profitable to play according to the rules, than to break them - we say Bitcoin is incentive compatible. This seems to hold true, even 10 years after the inception of the protocol. One cannot overestimate the foresight and thought that went into building such a system.

Evaluating a protocol and its inherent incentives fall into this category:

In game theory, games in which cooperative behavior can only be enforced through self-enforcing agreements are called non-cooperative games, whereas games allowing strategies relying on external enforcement are called cooperative games.

This is one of the great innovations introduced with Bitcoin; a self-enforcing agreement on a global scale between unknown entities that don’t trust each other. This is only possible because of an incentive system that makes honest behavior more profitable than fraudulent behavior.

It can be difficult to see why we consider all this to be a groundbreaking innovation when we look at the different parts of a blockchain. It is true that most concepts that comprise Bitcoin have been around for years. Game theory is arguably the most important part of a public blockchain protocol.

The design of the incentive-structure is the reason why Bitcoin was the first cryptocurrency that survived - few know that there have been many attempts to build a similar system before. They were either highly centralized or didn’t provide the right incentives for their participants.

Decentralized Consensus

Before Bitcoin it was not possible to achieve consensus in an environment with untrusted participants showing malicious, or Byzantine, behavior and an unreliable asynchronous network.

Self-Enforcing Agreement

One of the most important incentives in Proof-of-Work blockchains is to have miners spend real resources, like electricity and mining equipment, on securing the ledger and rewarding them with the native currency on that blockchain.

This builds a thermodynamic layer of security around the ledger, that is only vulnerable to an entity that is willing to acquire a large amount of computing power and spend large amounts of electricity to break it.

As Satoshi Nakamoto formulated it in his Bitcoin Whitepaper:

"If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favor him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth."

The attacker now has to balance the cost of an attack on the blockchain: the likelihood of the attack being successful and its potential upside versus the benefit of spending the same amount of electricity on honest mining and collecting the block rewards.

The key takeaway is the following: the protocol of a blockchain is self-enforcing, as long as the incentives are set correctly. This is what lets rational agents decline invalid blocks and transactions and secure the network with their computing power.

Digital Scarcity

Bitcoin was the first technology that solved the double-spend problem. Before it was not possible to verify if a digital object existed only once.

When you transfer a unit of cryptocurrency, you hand over the ownership of a digital object and the receiver can be sure she is the new, sole owner of that digital object. The property of being double-spend-resistant is also called digital scarcity.

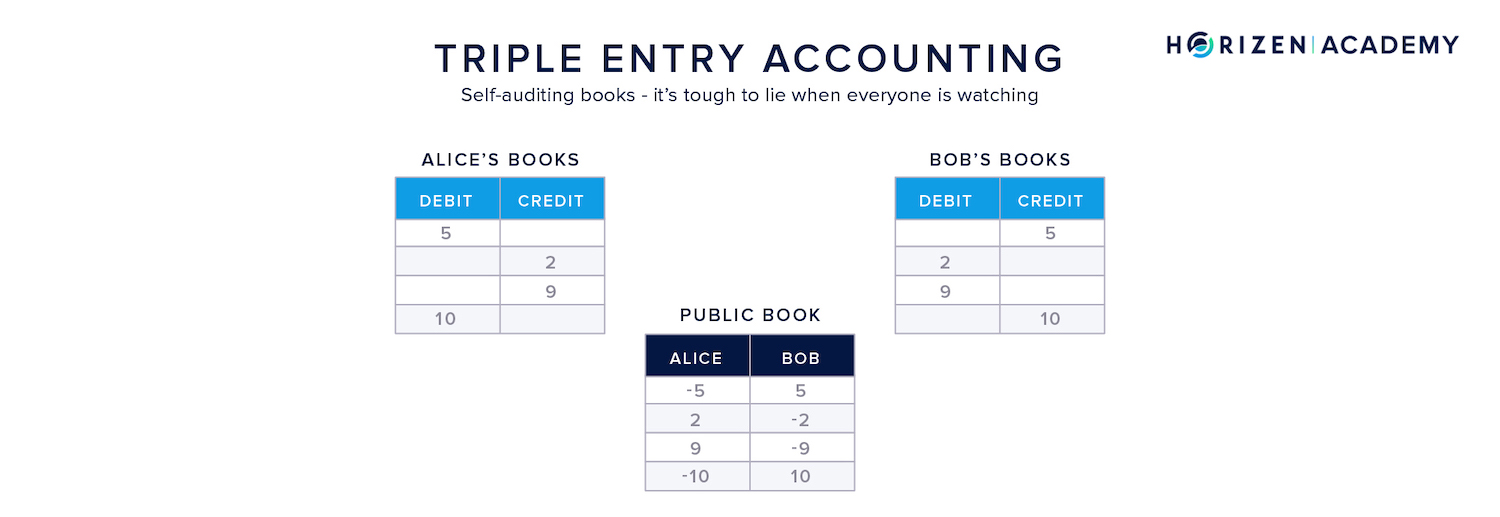

Introducing Triple Entry Bookkeeping

Over time accounting has evolved in three steps. First single-entry accounting was used, double-entry bookkeeping sparked the first revolution in trade, and Bitcoin introduced triple-entry bookkeeping in 2009, which might spark another revolution in commerce, trade, and accounting.

Single-Entry Bookkeeping

Single-entry bookkeeping is what you use for your personal finance.

You record incoming and outgoing transactions as positive or negative transactions and can calculate your current balance at any time. It does not work for commerce though, as you can’t trust another entity’s ledger. It is easy to create fraudulent activities while they are hard to detect.

Double-Entry Bookkeeping

Double-entry bookkeeping posed a revolution in commerce. Each participant creates two entries per transaction in their books: a debit and a credit. Any credit to yourself has to match a debit from another party.

Frauds are easy to detect, once you compare the books of interacting parties, but you have to rely on a third party acting as a validator to actually audit the books. It is still possible to cheat the system, but you have to create a whole history of fake transactions in order to do so.

Triple Entry Bookkeeping

Triple-entry bookkeeping now makes it impossible to create funds out of thin air, assuming the overall network is controlled by a majority of honest participants.

Each transaction comes with three entries:

- A credit to the recipient

- A debit to the payer

- And a public receipt, the recorded transaction on the ledger

Because everyone can keep a copy of the entire transaction history, no actor can create a fraudulent credit for themselves. You can trust the system itself instead of having to trust a third party like auditors or banks.

Triple-entry bookkeeping still comes with a downside: the total transaction throughput is limited, as it has to be processed by all participants of the network.

Separation of Money and State

Historically, it is the exception to have central banks making monetary policies with the scope it’s done today. We don’t want to start an economic discussion, as this is a topic in and of its own, but it surely can’t hurt to have a decentralized, permissionless and independent form of money as an alternative to the legacy financial system.

Competition is always good for service, and we believe we will see cryptocurrencies compete with state-issued fiat currencies soon.

Each of the ideas above is worth its own book and this brief overview doesn’t do justice to the relevance and intricacies of cryptocurrencies. We wanted to mention a few aspects nonetheless, to give you an orientation and a basis to research the different aspects you are interested in. None of the concepts above work in isolation.

They are interrelated and can be approached from different angles. When we extend the scope of blockchain beyond cryptocurrencies, we can find more interesting developments.

Non-Financial Incentives to Maintain a Blockchain

While financial applications in the form of digital money and digital proxies of traditional assets were the first and still are the most talked about use case, blockchain can be considered a tool to achieve other means.

When many parties that do not trust each other want to maintain a shared and consistent dataset, blockchain can be an option. The different entities can decide to run a node each and spin up a network amongst each other. Adding the right incentive structures and making sure that all actors in the system cannot abuse or corrupt the database is a large consideration, just as it is with any public blockchain.

If miners and nodes had no incentive to maintain the data in a consistent way, the blockchain would be useless. Usually, these incentives are of a direct financial nature.

But incentives can also be of a non-financial nature. If, for example, a group of businesses evaluate a shared database. Supply chain management is a good example: the producers want to prove they have sent a good in time, the logistics company wants to prove when it received and delivered a shipment, and the customer wants to see if and when his goods changed hands.

When every handoff is signed by the two directly interacting parties, it becomes easier to ascribe the responsibility in case of a late delivery. One could argue that the underlying incentive is of a financial nature, but this benefit results from efficiency improvements rather than direct monetary benefits.

Summary - A Protocol to Transfer Value

We can consider the mail to be a “protocol” to transfer physical goods and the internet with its underlying TCP/IP protocol, as a protocol to transfer information. Blockchain technology and cryptocurrencies provide a protocol to transfer value - from one person to another, without any intermediaries.

The protocol of a blockchain defines a set of standards. It determines what a block or transaction must look like to be considered valid.

The protocol of a blockchain is a set of rules that all participants must follow. It governs how to communicate data across the distributed network, what blocks and transactions have to look like and how participants are incentivized so that abiding the protocol is the most profitable strategy.

Some examples of the rules that comprise the protocol we mentioned are the longest chain rule that applies when there is a temporary chain split, the difficulty adjustment to keep the block production rate constant and the disinflationary monetary schedule.

Major innovations that blockchain technology has introduced are the self-enforcing agreement between network participants, digital scarcity, triple-entry bookkeeping, and the separation of money and state.