What is a Crypto Token?

A token is a digital unit of account that can be used to represent any kind of physical or digital asset on a blockchain, including:

- Currency

- Video or music files

- A piece of artwork

- Machinery

- Even a person

Tokens play a central role in allowing people to denote, store and exchange different types of assets on top of a decentralized network.

Tokenization, the process of creating tokens on the blockchain or converting digital or physical assets into tokens, is at the core of what powers the most successful decentralized applications and blockchain networks in our industry.

Tokens are a highly powerful tool that can serve as:

- A store of value

- A transactable currency

- A key instrument for incentivizing user adoption and coordinating action amongst millions of autonomous individuals.

Token Use Cases

When we think about the fact that almost anything in the physical or digital world can be represented as a token, the number of possible use cases for digital tokens are endless.

Here are some of the most common use cases that have been adopted in the blockchain space so far.

Medium of Exchange - Currency

A currency or medium of exchange is the most commonly understood use case for tokens, a ‘crypto token’ if you will.

Most tokens are created to serve as the primary currency within a blockchain network or decentralized application, or dapp. Users are typically required to pay for whatever good or service they are receiving from the dapp using its token.

For example, an NFT marketplace might choose to price all NFTs in their token and require users to have their token in their wallet to pay for an NFT.

Using a token as a currency has many advantages for the user and the creator.

For the users, token transactions can be faster, less costly and more transparent and secure than transacting with fiat currencies using centralized payment networks like Venmo or Paypal.

Users also get access to an open and permissionless network where everyone can exchange any type of goods or service without restriction using the token.

For creators, the currency use case is one of the best ways to bring value to both a product and a token.

Creators can design incentive programs to reward users who transact in their currency with more tokens, or access to more exclusive offerings

Store of Value

Storing value simply means to preserve one's wealth in an asset that either retains its current price or increases in price overtime.

The measure of a good’s store of value is whether an asset can help investors to combat inflation and increase their purchasing power relative to the rising costs of goods and services.

For example, if I can store $100 in an asset today and receive $150 in 1 year, this asset has increased my purchasing power by 50%, while also beating inflation, the general rise in prices, which is currently around 8%.

Tokens are a technology that can be used to represent existing stores of value like stocks or gold on the blockchain, allowing them to be transferred and their ownership to be verified in a more transparent and secure manner.

Tokens can also be used to have utility within a blockchain or dapp, example as a form of collateral or transactable currency. As the dapp or blockchain grows in adoption, the utility and therefore the value of the token also grows, enabling it to potentially serve as a good store of value.

Reward Instrument

As mentioned before, tokens can be leveraged as the ultimate tools for rewarding users of a product to continue using it or to share it amongst their friends.

Crypto projects often launch marketing bounty programs that reward existing users for referring people within their network to use the product and join the project's community.

There can also be bug bounty programs which reward developers or end users for testing and finding bugs in the products software. Tokens earned can either be stored in the users wallet or traded for stablecoins like USDC or USDT or cryptocurrencies like ETH or BTC.

Token reward incentives help crypto projects to foster community growth by giving back to those who help support the project.

Token reward instruments can also be presented in the form of a voucher that is redeemed for different types of goods and services (e.g free products, trips, etc). You can even have Fan Tokens that reward those who are loyal to a brand or celebrity by giving them access to exclusive offerings such as limited edition items or VIP tickets to live events.

There are many other interesting use cases that can be applied to tokens:

- Voting on proposals set by a decentralized autonomous organization or DAO

- Using tokens as collateral to receive loans or perform tasks that would otherwise require trust

- Through the use of non-fungible tokens, you can even create a unique digital identity or certify the scarcity of a digital item by showing proof of its limited supply.

What is the Difference Between a Cryptocurrency and a Token?

The difference between a token and cryptocurrency is subtle but important for understanding the possibilities and limitations of their utility.

Cryptocurrencies are the native currencies of a blockchain that are paid to miners or validators as rewards for correctly validating transactions and also securing the network.

Examples of cryptocurrencies include:

- Bitcoin

- Ether

- ZEN

Tokens are more customized versions of cryptocurrencies that are typically launched as part of a dApp and can be designed for a variety of purposes, however they are not used to reward miners or validators to verify transactions on a blockchain.

Examples of tokens include:

UNI - A token for voting on decisions made by Uniswaps DAO

USDC - A stablecoin token that is pegged to the price of a dollar

MANA - A token used to pay for virtual land on the metaverse project Decentraland.

Tokens are created using a smart contract, which is a computer program that automatically executes a set of functions based on predefined rules or conditions set by the developer.

These rules include the tokens:

- Maximum Supply

- Rate of Issuance

- Ownership Structure

What Problems do Tokens Solve?

Authentication of Ownership

I can prove that I own something of value on a transparent and globally distributed network

Transferability

I can transfer my ownership of an asset to anyone in the world anywhere without restrictions

Creates Liquid Markets for Assets

I can develop a market for people to connect from anywhere in the world to trade ownership of digital or physical assets in a transparent, secure and trustless way.

All of these problems are solvable through the use of blockchain technology.

As a reminder, a blockchain is a decentralized ledger (or record book) that is shared across a distributed network of computers (or “nodes”).

All nodes store the same copy of the ledger, and rely on majority consensus to determine when to update the ledger to reflect changes in the form of network updates or newly confirmed transactions.

Tokens exist on top of a blockchain as an entry on the ledger.

This allows anyone to attest to the rules around the tokens supply, ownership and functionality as it is written in its smart contract.

Token Standards

Fungible - ERC-20

Ethereum Request for Comments or ERC-20 is a token standard on the Ethereum network that enables users to issue fungible tokens.

Fungible tokens, like dollars or euros, carry the same value for each unit and can be exchanged one for one.

Examples of fungible ERC-20 tokens:

- USDC

- LINK

- DAI

- UNI.

Non-Fungible - ERC-721

ERC-721 is a token standard that allows users to create non-fungible tokens. Unlike fungible tokens, every non-fungible token contains a unique identifier code and cannot be divided or traded for other non fungible tokens.

Using smart contracts, people can issue NFTs on the blockchain, which can be used to certify the authenticity and uniqueness of a piece of art, a digital identity or any other type of asset.

Semi-fungible - ERC-1155

ERC-1155 is a token standard that allows users to create semi-fungible tokens. These are tokens that contain both fungible and non-fungible qualities within the same smart contract.

One example of this is in a video game where an ERC-1155 token can be used to create an NFT representing in-game assets like weapons or health packs.

These items can be traded one-for-one as fungible assets within the game, but also have unique properties that makes them non-fungible as a group of assets, meaning they cannot be traded for similar ERC-721 items outside of the game.

Conclusion - What is a Token?

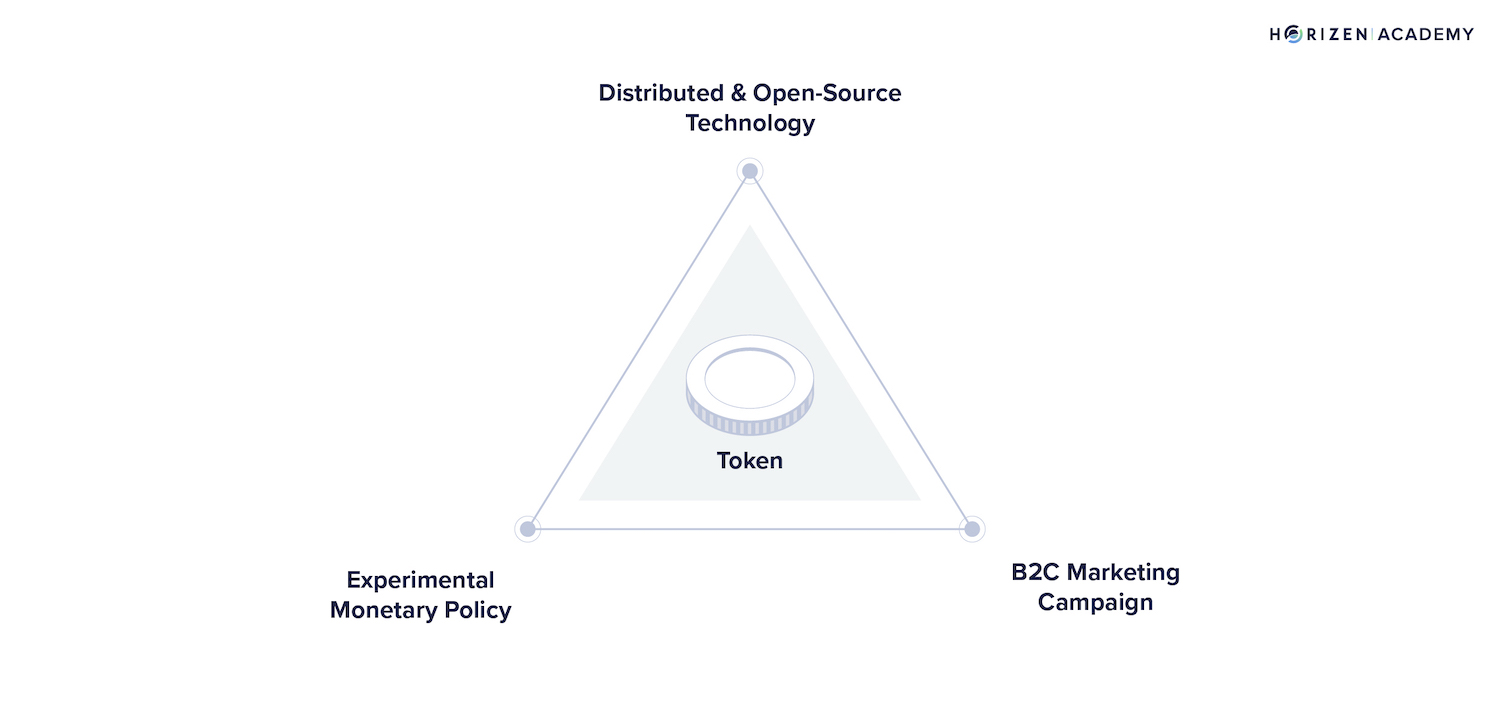

To conclude, a token represents the perfect blend between distributed and open source technologies, experimental monetary policies and high retention B2C marketing campaigns.

Each element is crucial to making a token successful, which is why we are seeing people from all kinds of backgrounds, including technology, business and economics express interest in launching a token.

Tokens provide prospective customers with strong incentives to adopt new products, dapps or blockchains, while empowering developers to bootstrap an entire network from scratch without the need of traditional fundraising or connections.

At Horizen, we strongly believe that tokens will continue to serve as the driving force behind the wave of innovation in the blockchain space and growth in adoption of decentralized applications in the coming years.

This is why we have created TokenMint, a tool that allows anyone to quickly launch their own token without the need of technical knowledge or blockchain experience.

On TokenMint, you can:

- Instantly launch a fungible token without any technical expertise required

- Customize your tokenomics

- Store your token on our Cobalt Wallet extension

- View the transaction history of tokens on our Tokenmint explorer